MANFRED WIEGEL

Subscribe to the monthly newsletter

In our newsletter we send out the monthly management commentary as well as invitations to events. You can register for the newsletter using the form below.

In accordance with the double opt-in procedure, after sending the registration form you will receive a further e-mail in which you confirm your inclusion in the mailing list with a further click.

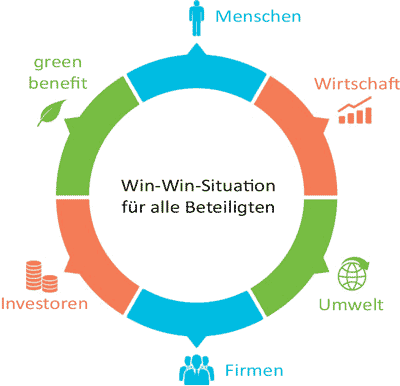

Win-Win Situation

With our investments we aim for a positive impact for all parties involved. After all every investment has an impact, the question is whether positive or negative. Through our investments, the positive impact on people and the environment is our top priority, whereby economic benefits are generated at the same time.

Our Fund

Our main product is our green benefit Global Impact Fund.

(Until 01.01. 2020 the name was green benefit Nachhaltigkeit Plus)

It invests according to social, environmental and economic criteria.

With an average equity allocation of over 95%, it is a pure equity fund with a high active share (100%) compared to the STOXX ESG Global Leader Index.

We systematically implement our strategy with “High Passion”:

High Conviction = 25 to 35 positions in the portfolio

Focus on bottom-up Stock-Picking

Focus on Growth stocks and Small-/Midcaps

Our engagement

Signatory of the PRI Principles

The PRI is the world’s leading representative for responsible investments.

It is committed to understanding the impact of environmental, social and governance (ESG) factors on investment and to helping its international network of investor signatories incorporate these factors into their investment and ownership decisions. The PRI acts in the long-term interests of its signatories, the financial markets and economies in which they operate, and ultimately the environment and society as a whole.

The PRI is completely independent. It encourages investors to make responsible investments to increase returns and manage risk more efficiently, but does not act in its own interest; it works with global policymakers but is not affiliated with any government; it is supported by, but not part of, the United Nations.

<p>The Principles were developed by investors for investors. By implementing them, signatories contribute to the development of a more sustainable global financial system. They have attracted a global signatory base representing a majority of the professionally managed investments worldwide.

Principle 1

We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2

We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3

We will seek appropriate disclosure of ESG issues by the companies in which we invest.

Principle 4

We will promote the acceptance and implementation of the principles in the investment industry.

Principle 5

We will work together to improve our effectiveness in implementing the principles.

Principle 6

We will report on our activities and progress in implementing the principles.

“An economically efficient, sustainable global financial system is a necessity for long-term value creation. Such a system will reward long-term, responsible investment and benefit the environment and society as a whole.”

The PRI will work to promote this sustainable global financial system by encouraging the adoption of the principles and cooperation in their implementation; by promoting good governance, integrity and accountability; and by addressing obstacles to a sustainable financial system that lie in market practices, structures and regulation.

Signatory of the PSI (Tobacco-Free Finance Signatories and Supporters)

The UNEP FI Principles for Sustainable Insurance, presented at the 2012 UN Conference on Sustainable Development, provide the insurance industry with a global framework for addressing environmental, social and governance risks and opportunities.

The purpose of the PSI initiative is to better understand, prevent and reduce environmental, social and governance risks and to better exploit opportunities for high-quality and reliable risk protection.

Principle 1

We will integrate environmental, social and governance issues relevant to our business into our decision-making.

Principle 2

We will work with our customers and business partners to raise awareness of environmental, social and governance issues, manage risk and develop solutions.

Principle 3

We will work with governments, regulators and other key stakeholders to promote broad-based community action on environmental, social and governance issues.

Principle 4

We will demonstrate accountability and transparency by regularly publishing our progress in implementing the principles.