Our understanding of sustainability

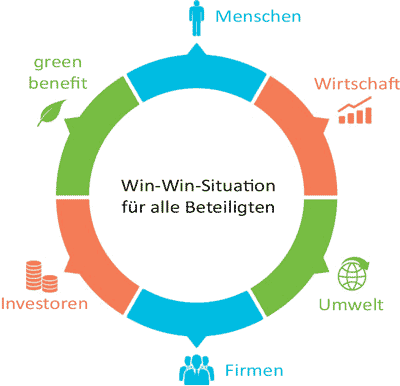

Who benefits from sustainability?

People

The SDG's have given us a unique opportunity in a generation to promote economic prosperity, protect our planet and improve the lives of billions of people

Economy

Climate change and the lack of climate protection cause considerable economic damage, which is reduced by the promotion of sustainable technologies

Environment

Example electric bus: Savings of 300 tons of CO2 per year 194 USD fuel costs vs. 50 USD electricity costs daily -> savings of 144 USD per day

Investors

Achieving good long-term returns with companies that particularly benefit from sustainable future trends and thus have an influence on sustainable development

Companies

Support in the manufacturing of products with a positive effect on the environment

green benefit AG

Company philosophy is fully focused on sustainable investment, positioning us strongly in one of the 5 major megatrends of the 21st century

4 positive examples of sustainable companies and their impact on the SDGs (Sustainable Development Goals)

Nel ASA, is the world market leader for electrolysis and hydrogen filling stations. The company provides solutions for the production, storage and distribution of hydrogen from renewable energies. The company’s hydrogen solutions cover the entire value chain from hydrogen production to the manufacture of hydrogen filling stations and offer electric vehicles with fuel cells the same refuelling and range as conventional vehicles.

- Use of hydrogen for transport vehicles without emissions, storage of renewable energies

- Hydrogen and fuel cell technology have the potential to become the key technology of the future.

- Hydrogen technology for diesel engines

- Reduction of emissions from existing diesel vehicles

- Germany Innovation Award

- Amortization of costs after 9 months

- Bridge technology with high global market potential

Savings of

- 88 % NOx

- 54 % Fine dust pollution

- 9 % CO2

- 52 % hydrocarbon

- 9 % Fuel consumption

Jinko Solar, is a Chinese manufacturer of solar wafers, solar modules and cells and is one of the leading solar companies worldwide. JinkoSolar has branches in Asia, North America and Europe. The company has developed and put into operation the first Chinese fully automated production line for photovoltaics. As one of the largest manufacturers of solar products, JinkoSolar has established a worldwide center for research and development together with leading universities.

Covers 3 of the 17 SDG’s

Clean energy is possible through solar, which makes cities and communities more sustainable and at the same time has positive effects on climate protection

United Natural Foods ist in den USA eines der führenden nationalen Vertriebsunternehmen im Bereich Natur-, Bio- und Spezialnahrungsmitteln. Die breitgefächerte Produktpalette umfasst zum einen natürliche, biologische, frische sowie Tiefkühl-Lebensmittel, zum anderen Körperpflegeprodukte und Nahrungsergänzungsmittel. Der Fokus der Gesellschaft liegt auf dem Vertrieb von hochqualitativen Produkten, der Bereitstellung von Service und Informationen, der Unterstützung der biologischen und nachhaltigen Landwirtschaft sowie dem Umweltschutz.

UNFI wurde zum 6. Mal in Folge zum grünen Spitzenreiter der Nahrungsmittellogistik ernannt.

Negative example of an otherwise sustainable company from which we exited for ethical reasons

Since 2015 we have held shares of BYD

Company profile

BYD is a Chinese high-tech company with IT, automotive and renewable energy as its core business. BYD is one of the largest manufacturers of rechargeable batteries and cell phone cases, and has one of the world’s highest market shares of nickel batteries, Li-ion batteries and cell phone chargers. The BYD Auto brand achieved a growth rate of over 100 percent for the fifth consecutive year. In the electric car sector, BYD develops and produces the necessary technologies. The company was quick to launch green products such as electric bicycles, energy storage solutions and solar power stations.

- World market leader for electric vehicles

- World’s largest producer of batteries

- Main supplier for Nokia, Motorola, Samsung, Sony, Kyocera and Huawei

- Warren Buffet owns 8.3% of BYD

- Use of electric motors for transport vehicles without exhaust fumes

- Energy storage, higher efficiency and environmental friendliness of products

Why we still decided to exit this position in December 2020:

In November 2020, we obtained information via various media (see links below) about the design of the new BYD D1 and the obvious similarities with the VW ID3. This and other information led to the decision to take the very problematic possible plagiarism infringement as a reason to sell all shares of BYD in our fund in December 2020 for ethical reasons.

What sustainability standards do we use?

Taxonomy of the European Union

With the Sustainable Finance project, the European Union made great progress towards the end of 2019 in terms of a common classification system at European or global level that defines environmentally sustainable economic activities. In particular, two challenges are to be addressed:

- Less fragmentation due to market-based initiatives and national procedures.

- less “greenwashing,” i.e., the practice of marketing financial products as “environmentally friendly” or “sustainable” when in fact they do not meet basic environmental standards

Outlook

The taxonomy for climate change mitigation and adaptation is to be produced by the end of 2020 for full application from the end of 2021. For the other four goals, it should be created by the end of 2021 and applied from the end of 2022.

Four criteria for three classes of environmental sustainability

Contribution to environmental objectives

They must contribute "significantly" to at least one of six environmental objectives defined in the Regulation

No violation of the objectives

They shall not "significantly" compromise any of these environmental objectives

Compliance with evaluation criteria

They must meet the "technical evaluation criteria", which define, for each environmental objective, what constitutes "significant" contribution and "significant" impairment.

Compatibility with labour law

They must be compatible with a "minimum protection" for workers.

SDG - Sustainable Development Goals

The SDGs are an elementary component of our investment process. When selecting investment opportunities, we make sure that none of the objectives are violated and that as many objectives as possible are met at the same time. Currently an investment covers on average 3 goals of the 17 SDGs.